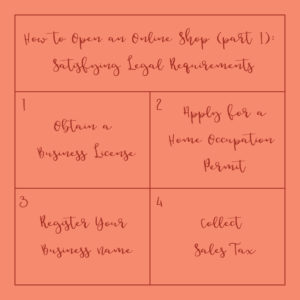

How to Open an Online Shop (part 1): Satisfying Legal Requirements

When someone opens an online shop especially on an established site like Creative Market or Etsy, they often overlook the legal requirements that they have to satisfy in order to start selling their designs. When I applied to open a shop on Creative Market and was accepted I had contacted every organization under the sun to get information about what I would need to do to before I started selling my designs online and while I got varied responses each time, there were 4 basic actions I found that I needed to do to open a legal graphic design business. Before I get into these 4 basic actions I should say that I am not a lawyer so anything I write in this post should not be taken as gospel. If you need legal advice about your business contact a lawyer. Also, this post is meant to document my process of opening a shop in the United States. Depending on the state and even city you live in your process/law requirements might be slightly different than mine so this post should be used in conjunction with your own research.

Let’s Get Started!

1. Obtaining a Business License

Before I even got into graphic and surface pattern design, I was heavly considering selling products on Etsy. I came across a forum of Etsy shop owners talking about if they needed a business license or not for their shop and the common theme of their discussion was that most of the shop owners did not have a business license. I had no idea that you would need a business license for something I wasn’t planning on making a lot of money off of so as I don’t like to break rules/laws, I heavily researched what I need to do to open a shop for about 2 years and this is what I found. Yes, you do need a business license to legally operate your business in the United States. You’re city government usually hands business licenses out. This may vary depending on the city that you live in so your best bet is to contact your city’s government (usually city hall), tell them what business you plan on opening and what you need to do to make your business legal.

2. Applying for a Home Occupation Permit (HOP)

For anyone planning to work from home, you may need to apply for a HOP permit. This is essentially an agreement that you will not conduct business out of your house that creates unnecessary noise, deals with dangerous chemicals, brings unnecessary traffic to the neighborhood, etc. Some cities may not require this step or may call this permit a different name, but always contact your local government to make sure.

3. Registering Your Business Name i.e Doing Business As (DBA) or Registering a Fictitious Business Name (FBN)

A Doing Business As or a Fictitious Business Name are two fancy ways of saying you are registering your business name. One of the main reasons you need to do this is because you are essentially announcing your business to the world so if someone wants to sue you for wrongdoing they know who to sue. It also protects your name from being used by other companies. If you plan on using a name other than your legal given name for your business name then you are required by law in most cities to obtain a DBA/FBN. It is important to note that if you use a business name that makes it sound like there is more that one person involved in the business like “Bob Garcia and Sons” or “Sarah Lang’s Design Group” you would still need to obtain a DBA/FBN even if you use your name in the title. Typically your county provides DBA’s/FBN’s but results may vary. To obtain a DBA/FBN you are often required to place one or multiple ads in your local paper over a set period of time so it is often easier and less time consuming to use your real name as your business name so you don’t need to register your business name.

4. Collecting Sales Tax

The last thing you need to be conscious of when starting a business is that you might need to collect sales tax for your business. Depending on the city you live in, you might need to collect sales tax for both your state and local government. Most states and sometimes even counties have sales taxes so check with both entities before you open your shop. The way online sales taxes work in some states is you only need to collect sales taxes for sales where the person lives in your state. For instance, if you live in California you only need to collect sales taxes from people who also live in California. This law is different in each state and may be subject to change very soon so you should always be checking every year to see if anything changes. Also in California at least, you do not need to collect sales taxes on digital products. For example, if you are selling your surface pattern designs where all your customer gets is a digitally transferred file of the design you will not need to collect sales taxes. If a physical copy of the design is then sent to the customer on a CD or a USB or in the form of a product then you would need to collect sales taxes. This law also varies by state so you should contact the state entity that is responsible for collecting sales taxes (in California it’s the State Board of Equalization).

That’s It!

This is a guide for legally starting your online business and will vary depending on what state you live in. To make sure you are following all legal requirements you should contact your state, county, and local organizations explaining what your business is and asking what you need to do to make your business legal. For those of you who do have online businesses, is there any other advice that you would give new business owners? Leave a comment down below.

If you liked this post, why not share it! It lets me know what posts you like so I can make more posts like this.